Financial Results for Fiscal Year 2010

Overview

The financial outcome of the 2010 fiscal year reflects the response of the University of Chicago and the University of Chicago Medical Center to the impact of the previous year’s economic challenges. The financial performance results from improving economic conditions and from actions taken internally during the 2009 and 2010 fiscal years by both entities.

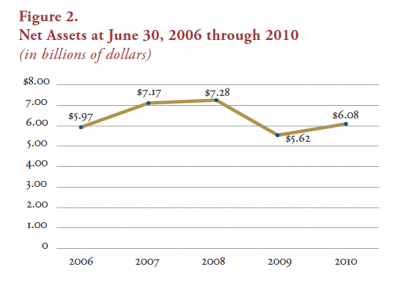

The University’s overall financial position has improved over that of the previous year. Net assets increased by $459.10 million during the year to a total of $6.08 billion. The University ended the year with an excess of operating revenue over expenses of $157.75 million. Strong operating results, investment gains, and receipt of private gifts were key contributors to the improvement in overall financial position.

Net Assets

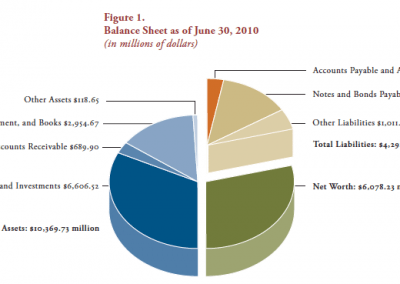

The balance sheet of the University of Chicago as of June 30, 2010, is stronger when compared to the end of the previous year, with total assets increasing by $985.11 million to $10.37 billion during the year. The largest asset category, investments (primarily the endowment), experienced an annual return of 18.9 percent. Land, buildings, equipment, and books—the second largest asset category—increased by $246.74 million. The increase represents funds invested in new construction and capital renewal projects. The new construction was financed through gifts and issuance of debt. This new debt, plus an increase in pension and other post-retirement benefit obligations, accounts for the majority of the increase in liabilities. Balance sheet categories are shown in figure 1.

The increase in net assets of $459.10 million reflects a positive change depicted in the trend line showing net asset value over the past five years (see figure 2). Net assets increased from $5.62 billion to $6.08 billion during the past year. Investment gains, both unrestricted and restricted, and restricted private gifts account for a major portion of the increase in net assets (see The Endowment). The operating results of the University and the Medical Center also made a major contribution to the increase in net assets. Other changes in net assets during the 2010 fiscal year include:

- A decrease in pledges, notes, and accounts receivable of $55.09 million

- New investments in land, buildings, equipment, and books of $439.80 million, offset by depreciation of $193.06 million

- A net increase in notes and bonds payable of $299.54 million

- Increases in accounts payable and accrued expenses of $72.08 million

- Other net increases of $137.39 million

Results of Operations

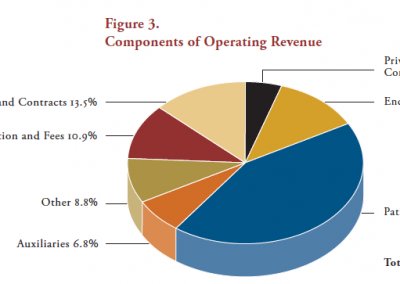

The $157.75 million excess of operating revenue over expenses was driven by operating revenue of $2.92 billion less operating expenses of $2.76 billion. Increases in operating revenue over the prior year are attributable to increased government research grants, an increase in the endowment payout rate, and increases in private gifts. Expenses increased at a slower pace than revenue due to reductions in staff salaries, offset by increases in benefit costs, depreciation, insurance, and supplies. The components of operating revenue and expenses are shown in figures 3 and 4.

Audited Financial Statements

The University’s fiscal year 2010 financial statements were audited by KPMGLLP. The complete audited financial statements for fiscal year 2010 are available online or by writing to Financial Services, 6054 South Drexel Avenue, Chicago, Illinois 60637.